Bitcoin price had a tremendous growth in recent months. This growth means that bitcoin holders become richer and richer. But how bitcoins are distributed really? Who hold the most bitcoins? JustCryptoNews.com tries to answer these questions.

Bitcoin is a decentralized cryptocurrency, but as it happens with fiat money, bitcoins are distributed unevenly; In math language, they follow a Pareto distribution. A Pareto distribution is often used to describe the allocation of wealth among individuals. Its main idea is that a large portion of the wealth of any society is owned by a small percentage of people. This idea is expressed simply as the "80-20 rule" (or the Pareto principle) which says that 20% of the population controls 80% of the wealth.

That should be the situation in Bitcoin as well. But, in fact, bitcoin distribution is even more uneven.

The poor: Most bitcoin addresses have very small balances

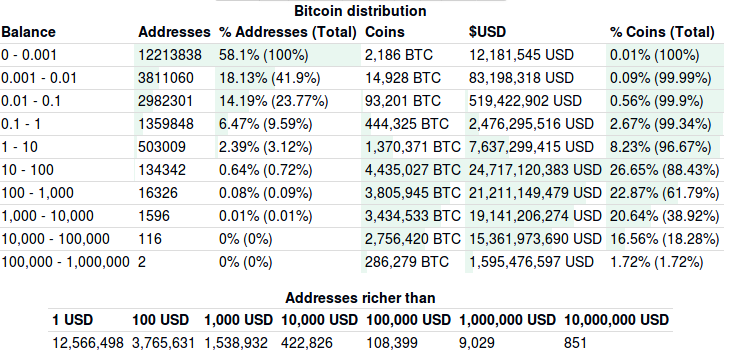

According to data published by bitinfocharts.com, a 58.1% of all bitcoin addresses hold a maximum of 0.001 BTC each. These are 12,213,838 addresses and the total sum of bitcoins they hold is just 2,186 BTC or a mere 0.01% of the total number of BTC in circulation today. The value of these coins is a little above the $12 million mark.

Another 18.1% (3,811,060 in absolute numbers) of all bitcoin addresses hold 0.001 to 0.01 BTC with a total of 14,928 BTC. This number is just 0.09% of all bitcoins minted with value at $83 million.

Thus, a vast majority (58.1% + 18.1% = 76%) of all valid bitcoin addresses hold a tiny fraction of all bitcoins: just 0.1%!

What about the rest 99.9% of all bitcoins?

Well, there are 2,982,301 (or 14.19%) bitcoin addresses which hold 0.01 to 0.1 BTC. The total bitcoins they hold is 93,201 BTC or just another 0.56% of total bitcoins.

There are also 1,359,848 (or 6.47%) addresses which hold 444,325BTC or 2.67% of all bitcoins. Each one of them has a balance 0.1 to 1 BTC.

At this point we have stumbled upon another significant statistic: The 96.89% of all addresses (58.1+18.13+14.19+6.47 = 96.89) hold a maximum of 1 bitcoin each. And their total balance in bitcoins is just 3.33% of all bitcoins minted today (2.67+0.56+0.09 + 0.01 = 3.33).

So, the rest 96.66% of all bitcoins today are owned by a tiny 3.11% of addresses.

Thus, to describe bitcoin distribution, we need to introduce a new rule: the "96-3 rule", where only 3% of the population (addresses) controls over 96% of the wealth (bitcoins).

Where Is The Middle-Class ?

This profoundly uneven bitcoin distribution means there is no 'middle-class' formation, in the context of the king of cryptocurrencies.

At the moment, there are only 503,009 addresses which hold 1 to 10 bitcoins. These are a drop in the ocean: 2.39% of the total addresses, and their total value is just 1,370,371 BTC or 8.23% of total bitcoins.

Nevertheless, you might get a glimpse of a middle-class if you consider the 134,342 addresses (or 0.72%) which hold 10 to 100 bitcoins and a total of 4,435,027 BTC (or 26%). Together with the 503.009 addresses above, you have a total of ~637.000 addresses (or 3.03%) with a total balance of over 5.7 million bitcoins, or 34% of the total coins today. Seen as percentage, that 3.03% is very small, but in absolute numbers one might think that bitcoin has made already thousands of people richer.

The ultra-rich bitcoiners

Care to know how many addresses have a balance of over 1000 bitcoins? That's at least 6 million dollars in today's bitcoin value, mind you. There are only 1714 addresses with that kind of bitcoin money in them. Each person holding such an address is a millionaire in fiat money.

But again, this clearly demonstrates the uneveness of bitcoin distribution. These 1714 addresses 'collectively' hold 61.79% of the total bitcoins today. In US dollars, that's over $36 billion.

The following table shows today's Bitcoin distribution in a nutshell: