3.79 million bitcoin is estimated to be lost permanently on the public blockchain according to recent findings. 20% of its total supply is unspendable, and despite bitcoin having reached the astronomical price of $10,200+ at the time of writing it is still considered by many mostly undervalued.

UPDATE: Bitcoin surpassed $15,000 on December 7, meeting the article's hypothesis that it has been -still is- undervalued!

At the time of reporting, the market valuation of bitcoin is at around $196 billion. The price of bitcoin is calculated by dividing the market cap with its circulating supply of 16.72 million.

But, according to a study conducted by bitcoin blockchain-focused digital forensics firm Chainalysis, approximately 3.79 million, or $43.5 billion worth of bitcoin is forever lost on the public blockchain of bitcoin. Thus, while the official circulating supply of bitcoin is 16.72 million, the actual amount of bitcoin is closer to 13 million.

Given that the real supply of bitcoin regarding the bitcoin that are not spendable or available on the bitcoin blockchain is 13 million, the price of bitcoin should be in the area of $15,000. As of current, bitcoin is moving in the $11,500 region across many exchanges.

On whether the market has priced the unspendable coins to provide the market appraisal of bitcoin, Chainalysis senior economist Kim Gauer stated:

That is a very complicated question. On the one hand, direct calculations about market cap do not consider lost coins. Considering how highly speculative this field is, those market cap calculations may make it into economic models of the market that impact spending activity. The market has adapted to the actual demand and supply available – just look at exchange behavior. Furthermore, it is well known monetary policy procedure to lower or increase fiat reserves to impact exchange rates. So the answer is yes and no.

Investors such as major US-based electronics retailer Overstock CEO Patrick Byrne believe that bitcoin is better than gold and fiat currencies like the US dollar because users have total control over their money and wealth.

You think that’s a bubble? What do you think that fiat currency you carry around in your purse is?”

Byrne told Maria Bartiromo.

This dollar stuff, it’s just some fiat currency based on … the surplus taxing authority of the U.S. Treasury of which I assert there is zero … It’s about time the world switches to real money. Either gold or bitcoin,

said Byrne.

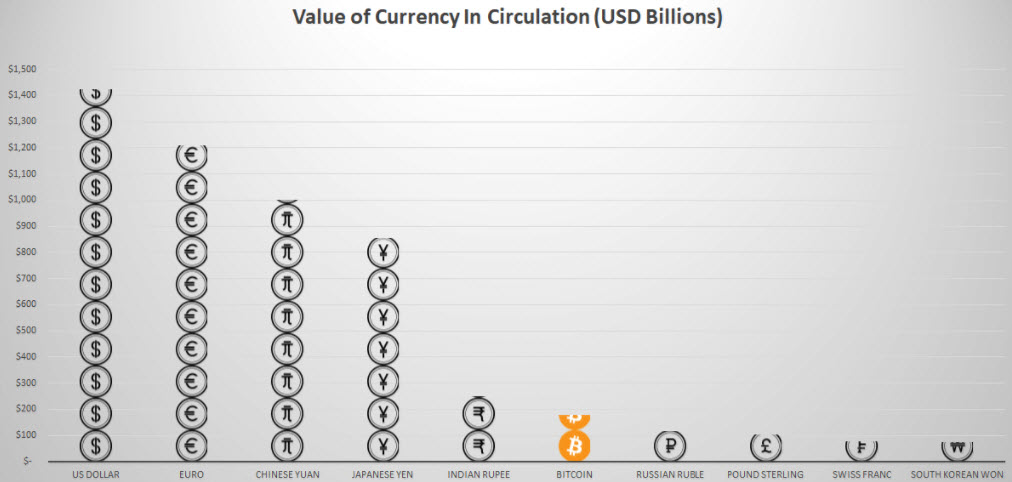

The total marketcap of Bitcoin is currently at 195 bln USD, making it the sixth largest currency in global circulation!

Do you think Bitcoin is currenclt undervalued? Lets disqus on the comments section below.