The last 24 hours have been somewhat scary for bitcoin investors as a lot of strange things happened, among which a flash-crash to $14,000 for Bitcoin (BTC) on GDAX and a massive price increase (over 50%) of the rival Bitcoin Cash (BCH). But the situation now begins to normalize. JustCruptoNews recaps what happened.

On the Bitcoin front, BTC price stopped tracking sideways and dropped almost 7 percent yesterday. According to coinmarketcap, BTC opened above $18,900, but it declined to $17,300 by the end of the day. That correction is not unusual for Bitcoin, and it came after CME Group launched the world’s second Bitcoin futures contract on Monday. For comparison, when Cboe launched its pioneering futures on Dec. 10th, Bitcoin markets had a 20% growth.

Monday saw CME futures close at $19,100, a 2.1% less than the debut price, although these contracts had slightly higher volumes than those of Cboe a week before. Market observators were relieved, after fears of shorting Bitcoin. Garrett See, chief executive of trader DV Chain told the Wall Street Journal:

"There was some fear ahead of the Cboe futures launch that Wall Street was going to come in and short Bitcoin, but we haven’t seen that."

But as we have reported earlier, during the last 12 hours BTC tumbled in all markets:

And flash-crashed to $14,000 on GDAX, after Coinbase announced trading of rival Bitcoin Cash coins:

The catalyst for the flash-crash appears to be a wave of selling from Coinbase users who were holding BTC. Or it might be some whale playing around who decided to dump hundreds of bitcoins sending the price plunging. Nobody knows for sure.

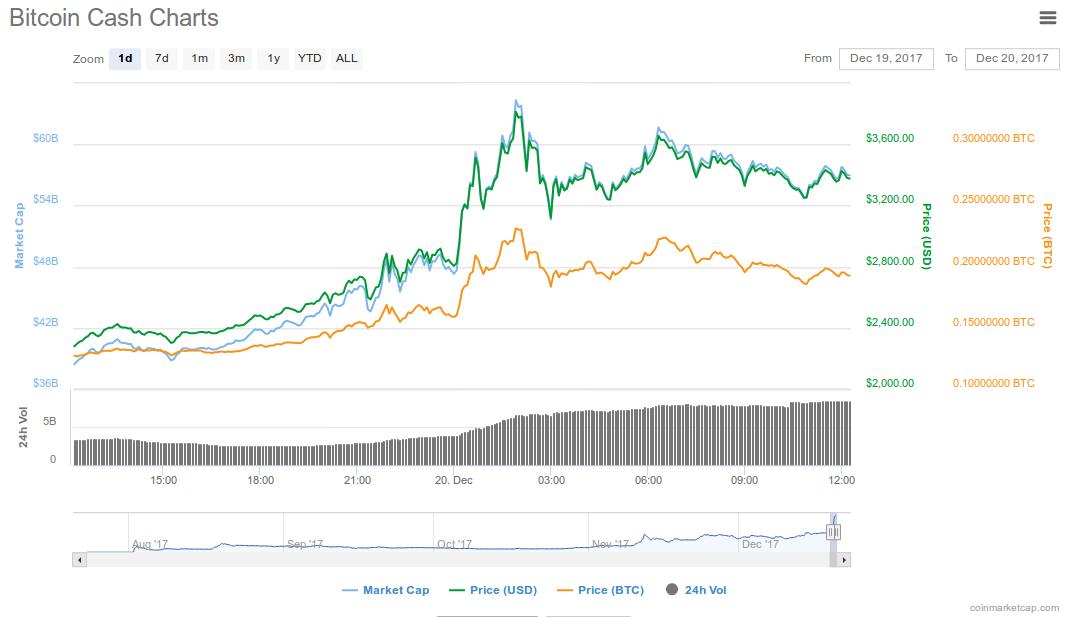

Meanwhile, Bitcoin Cash was on the rise the whole day but, following the Coinbase announcement, BCH went skyrocketed as high as $3,800:

Bitcoin Cash trading opened just above $2,100 on the day before. At press time, BCH is trading at $3,365, up 45% in the last 24 hours:

The flash-crash of BTC on GDAX along with the sharp rise of BCH price, prior and especially after the Coinbase announcement, pushed commentators (apparently on the "legacy" Bitcoin side) to talk about price manipulation and coordinated efforts to "tank Bitcoin". Some BTC die-hards even accused Coinbase of inside trading, as reported earlier. That prompted Coinbase's CEO to respond to the allegations promising an investigation into the matter and punishment of any party involved. Furthermore, some users accuse Coinbase of colluding to artificially increase Bitcoin Cash value, as the BCH-USD pair in GDAX has been frozen to $9,500 for over 12 hours.

Now that the dust has settled, Bitcoin seems to be rebounding to the $17,000 level while Bitcoin Cash remains steady above $3,000.

What do you think? Will BCH be able to rival BTC? Was there any price manipulation before or after GDAX listing?