Now that Bitcoin Cash shows signs of wanting to be the contender for the cryptocurrency throne, it's nice to see the reality in a few charts. JustCryptoNews.com reports for you.

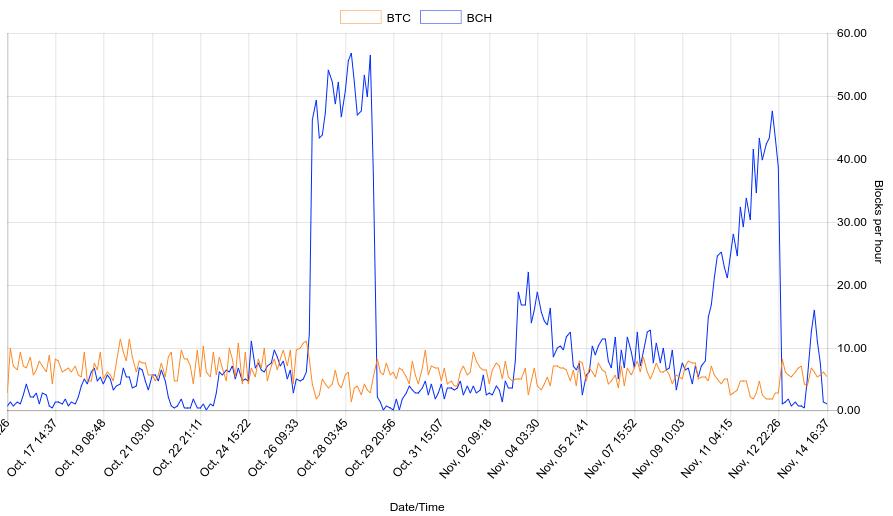

First, we've got the average number of blocks found every hour, in the last 30 days. Bitcoin shows a pretty-much constant rate of around six blocks per hour, while Bitcoin Cash blocks fluctuated heavily. There were times that more than 50 new BCH blocks were validated in a single hour. And that's not always something good.

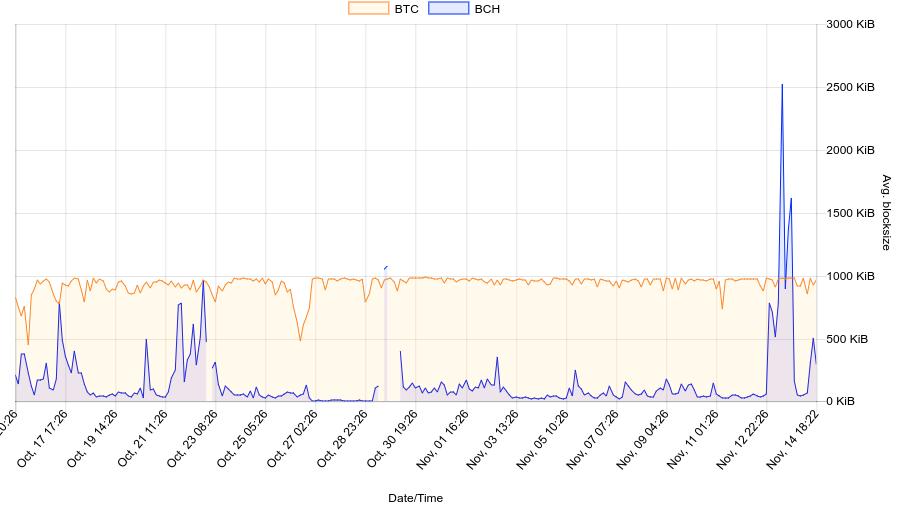

Now, have a look at the average block sizes. This is a highly political issue inside the bitcoin community, as "big blockers" argue that bitcoin should be used not only as a store value but also as a means of payment, which in turn means many transactions per second and thus the need for larger blocks. As you see Bitcoin, blocks remain at 1MB or a little more while Bitcoin Cash actual blocks are way smaller than that, even though the protocol supports blocks up to 8MB. Nevertheless, during last weekend's BCH rally, the blocks of the throne contender became larger than 1MB and briefly reached and surpassed the 2MB mark.

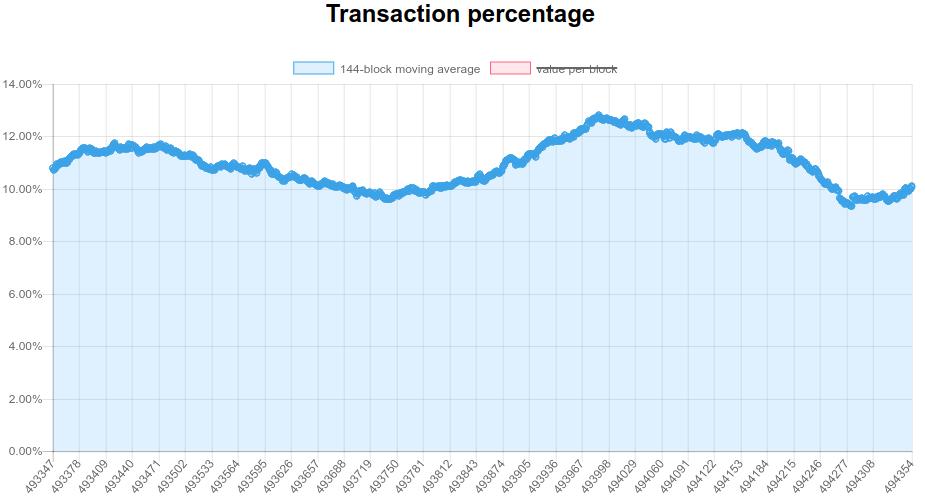

We know what you might be thinking when looking at the last chart. What happened to Segwit-enabled blocks? Well, Segwit adoption rose at >10% but at the moment segwit transactions seem to be stuck at around 12%. And we don't expect much to change, as long as Coinbase and other large exchange do not yet support it.

Having mentioned the poor adoption rate of Segwit, it should be noted that Bitcoin Cash does not support Segwit. Bitcoin proponent Charlie Lee believes this is because "miners need a coin to keep mining using AsicBoost" a controversial technology in mining rigs by Bitmain. Note that Bitmain has denied using this tech for such puposes.

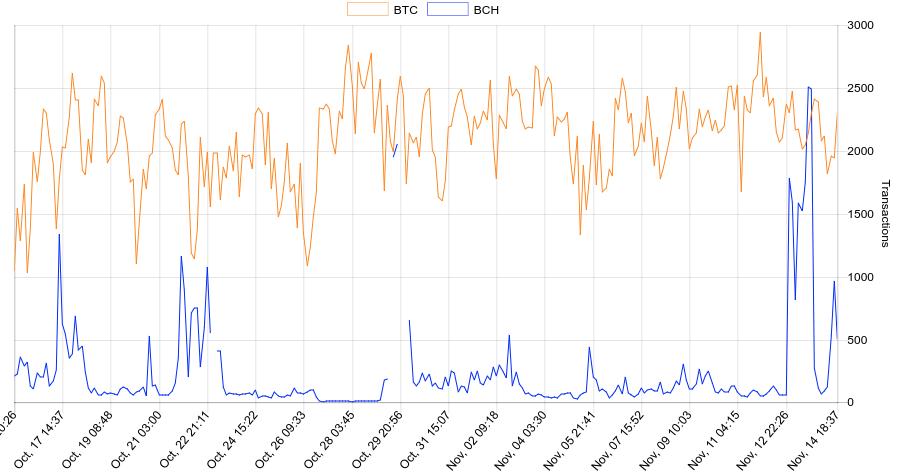

Relevant to the above remarks, the chart below shows the average number of transactions per block for each of the two cryptocurrencies. The original Bitcoin shows a rough average of 2,000 Transactions per block while BCH transactions are again way below that. During the last weekend's rally, Bitcoin Cash transactions rose to BTC levels but then retracted to previous levels (below 1000).

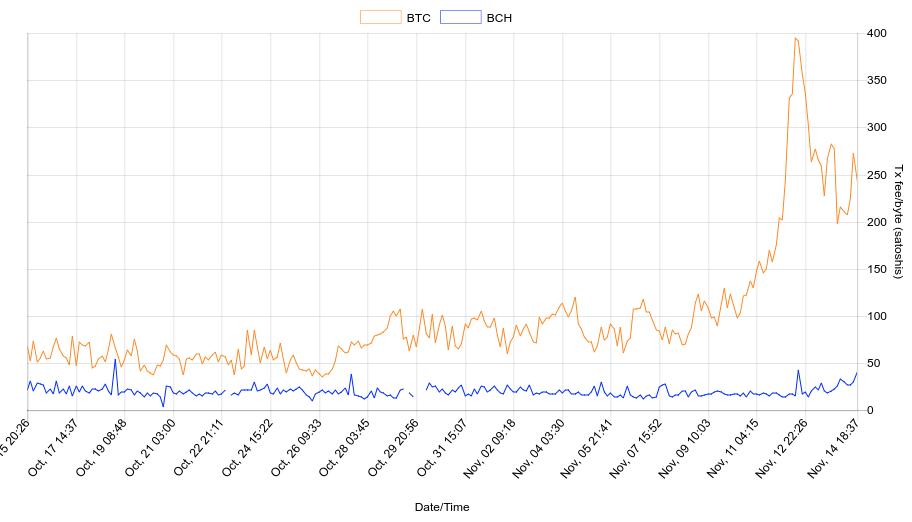

The chart below is the one that most BCH proponents will use to argue why, in their view, Bitcoin Cash is "the true Bitcoin". As you see, fees for BTC transactions are always higher or even double the fees for BCH transactions. Furthermore, after Nov 11 bitcoin users need to pay more than 200 satoshis per byte. For a 250-byte transaction, that's more than 3 dollars.

That is why Bitcoin Cash supporters like Roger Ver believe Bitcoin Cash will soon steal the crypto throne from Bitcoin:

Perhaps these BCH die-hards are right, and Bitcoin Cash price's rally over the weekend means the new cryptocurrency is preparing to rival Bitcoin. Meanwhile, the network is preparing for a new hard fork which will bring an updated Difficulty Adjustment Algorithm (DAA).

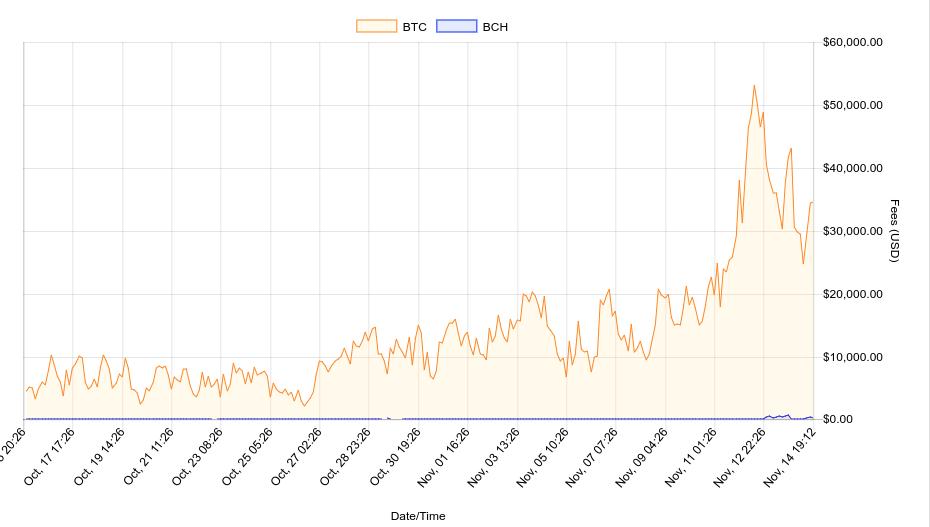

Nevertheless, due to much higher fees and much more transactions per block, miners do have a reasonable incentive to mine on Bitcoin, not Bitcoin Cash. The chart below shows the average amount of fees per block in USD for both cryptocurrencies. It needs no commenting perhaps, but do note that a miner gets more than 20,000 dollars in fees after mining a single BTC block. If he prefer to mine BCH, the same miner will get less than 300 dollars in fees from a Bitcoin Cash block...

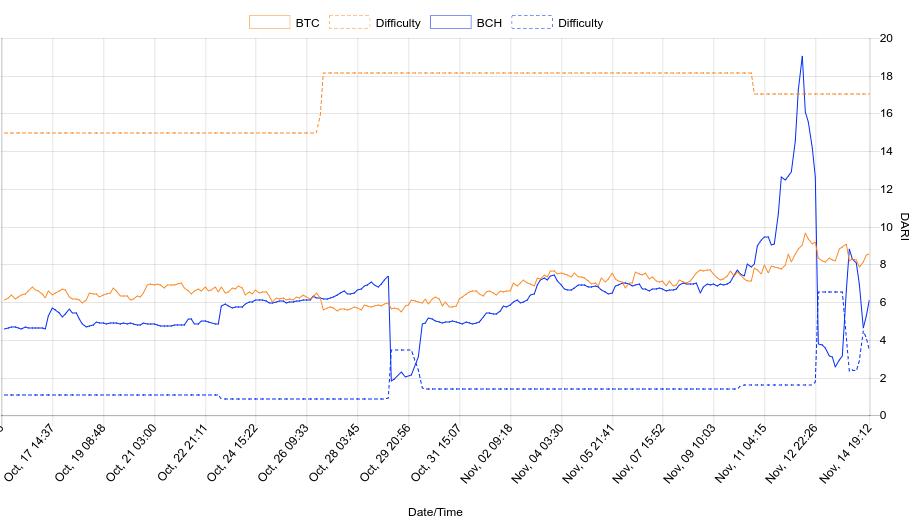

In the end, miners are all about making money to pay their bills. As any reasonable human would do, they have strong incentive to mine the most profitable coin. Which is the most profitable, BTC or BCH? Except the average fee chart above, you can consult the chart below which shows that BTC is more profitable at the moment, in terms of an index called DARI, but in the last days BCH managed to surpass it:

DARI stands for Difficulty Adjusted Reward Index and is computed by fork.lol as follows:

(block coinbase+fees in satoshis) / (block difficulty) * (exchange rate in USD)

The table below shows the relative mining profitability per coin, currently as well as in the last 6h, 1d and 7 days.

What do you think? Should Bitcoin be a store of value or a means of exchange? Are you a hardcore BTC hodler or a BCH enthusiast?

Images and data: fork.lol - Many thanks!